Torrent Pharmaceuticals Ltd. is reportedly considering raising up to $3 billion from global banks to acquire a controlling stake in JB Chemicals & Pharmaceuticals Ltd. The Indian drugmaker is exploring various financing options, including issuing dollar and local currency bonds, to fund the potential purchase of KKR & Co.’s 53.8% stake in JB Chemicals, according to sources familiar with the matter. Torrent is seeking financing from banks such as Barclays Plc, Deutsche Bank AG, and Standard Chartered Plc.

This year, JB Chemicals’ shares have increased by approximately 20%, giving the Mumbai-based company a market value of around $3.6 billion. The discussions about the stake acquisition are still ongoing, and no final decisions have been made. Other potential bidders may still be interested in acquiring the stake.

Representatives from Torrent, KKR, JB, and the banks involved declined to comment on the matter. KKR has been considering the sale of its controlling stake in JB Chemicals, as Bloomberg News reported in February. Torrent has been in discussions to acquire the stake, as Moneycontrol reported in April.

India has seen an increase in dealmaking activity this year, driven by its strong economic growth. Torrent Pharmaceuticals, the flagship company of Torrent Group, was founded as a small generics drug company in the early 1970s and specializes in therapeutic areas such as cardiovascular, central nervous system, and gastrointestinal treatments.

Related posts:

Union Finance Minister Smt. Nirmala Sitharaman chairs the review meeting of the Regional Rural Banks (RRBs) in New Delhi, today

Union Finance Minister Smt. Nirmala Sitharaman chairs the review meeting of the Regional Rural Banks (RRBs) in New Delhi, today

APSPDCL installs the state’s first high-tension and low-tension smart meters for the government sector.

APSPDCL installs the state’s first high-tension and low-tension smart meters for the government sector.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

US Fed must go big with 50 bps interest rate cut in September or risk recession

US Fed must go big with 50 bps interest rate cut in September or risk recession

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

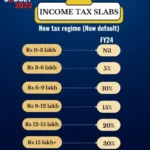

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)