In the Budget 2024, Finance Minister Nirmala Sitharaman introduced changes to the income tax slabs under the new tax regime, effective from April 1, 2024. These changes were confirmed in the full budget presented in July 2024, following the Lok Sabha elections, with no modifications made in the interim budget of February 2024.

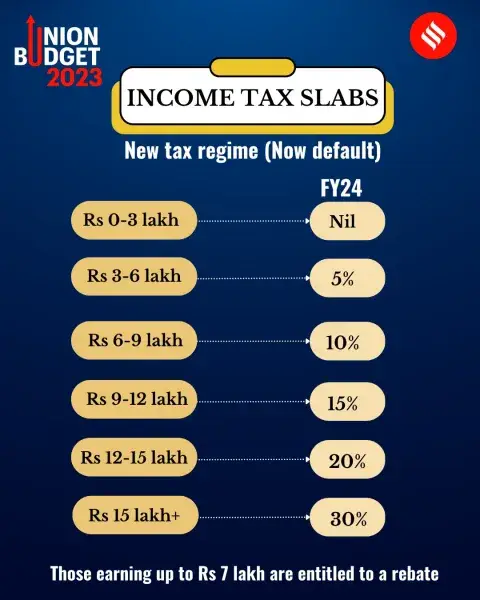

New Tax Regime Slabs and Rates (FY 2023-24)

- Income up to ₹3,00,000: 0%

- Income from ₹3,00,001 to ₹7,00,000: 5%

- Income from ₹7,00,001 to ₹10,00,000: 10%

- Income from ₹10,00,001 to ₹12,00,000: 15%

- Income from ₹12,00,001 to ₹15,00,000: 20%

- Income above ₹15,00,000: 30%

Key Changes:

- Expanded Slabs: The slabs from ₹3,00,000 to ₹6,00,000 have been raised to ₹3,00,000 to ₹7,00,000, and from ₹6,00,000 to ₹9,00,000 have been revised to ₹7,00,000 to ₹10,00,000. This means:

- Income up to ₹7,00,000 is taxed at 5% instead of 10%.

- Income up to ₹10,00,000 is taxed at 10% instead of 15%.

- Standard Deduction and NPS Contribution:

- Increased standard deduction limit.

- Higher employer’s contribution limit to the employee’s NPS account.

- Revised standard deduction for family pensioners.

- Tax Rebate: Tax rebate of up to ₹25,000 for taxable incomes not exceeding ₹7,00,000 remains unchanged.

- Surcharge: The surcharge applicable for incomes exceeding ₹2 crore remains the same.

Old Tax Regime Slabs and Rates (FY 2023-24)

- Individuals Below 60 Years:

- Income up to ₹2,50,000: Nil

- Income from ₹2,50,001 to ₹5,00,000: 5%

- Income from ₹5,00,001 to ₹10,00,000: 10%

- Income from ₹10,00,001 to ₹15,00,000: 15%

- Income from ₹15,00,001 to ₹20,00,000: 20%

- Income above ₹20,00,000: 30%

- Senior Citizens (60 years and above but below 80 years):

- Income up to ₹3,00,000: Nil

- Income from ₹3,00,001 to ₹5,00,000: 5%

- Income from ₹5,00,001 to ₹10,00,000: 10%

- Income from ₹10,00,001 to ₹15,00,000: 15%

- Income from ₹15,00,001 to ₹20,00,000: 20%

- Income above ₹20,00,000: 30%

- Super Senior Citizens (80 years and above):

- Income up to ₹5,00,000: Nil

- Income from ₹5,00,001 to ₹10,00,000: 10%

- Income from ₹10,00,001 to ₹15,00,000: 15%

- Income from ₹15,00,001 to ₹20,00,000: 20%

- Income above ₹20,00,000: 30%

Key Points:

- The old tax regime retains higher deduction limits, including deductions under Sections 80C, 80D, and 80TTA, among others.

- Tax Rebate: ₹12,500 rebate under Section 87A for incomes not exceeding ₹5,00,000.

- Standard Deduction: ₹50,000 available for salaried individuals.

- Deductions: Available for investments and expenditures, including Section 80C for investments up to ₹1.5 lakh.

Choosing Between Tax Regimes

- Old Tax Regime: Allows for multiple deductions and exemptions but has higher tax rates.

- New Tax Regime: Features lower tax rates but fewer exemptions. The new regime is the default; taxpayers must actively opt for the old regime if preferred.

For Business Income:

- Taxpayers with business income must choose between the two regimes annually. If opting for the old tax regime, they have a one-time option to switch to the new tax regime.

Summary

- The new tax regime offers revised slabs and reduced tax rates but limits deductions and exemptions.

- The old tax regime maintains higher deduction limits and tax rebates but with higher tax rates.

- Taxpayers should assess their individual financial situations to determine the most beneficial regime based on available deductions and overall tax liability.

Related posts:

Federal Bank Identifies Deposit Growth as Major Challenge for Indian Lenders.

Federal Bank Identifies Deposit Growth as Major Challenge for Indian Lenders.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

SEBI chairperson should resign, A probe JPC into Adani mega scam, Congress Said

SEBI chairperson should resign, A probe JPC into Adani mega scam, Congress Said

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Tax Exemption Limits for Allowances and Reimbursements Paid to Employees

Tax Exemption Limits for Allowances and Reimbursements Paid to Employees