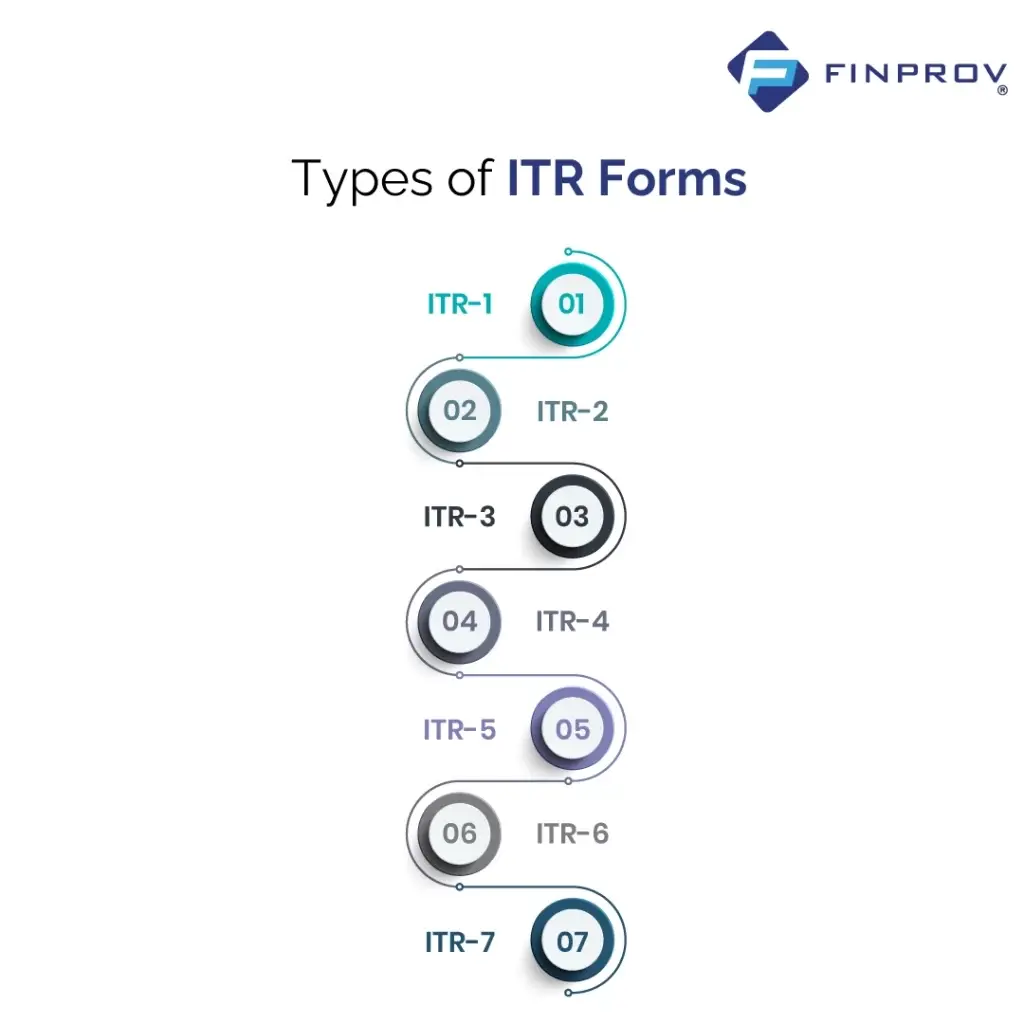

The Central Board of Direct Taxes (CBDT) has issued the income tax return (ITR) forms for the Financial Year (FY) 2023-24, which corresponds to the Assessment Year (AY) 2024-25. Notifications for the ITR-1 form were released on December 22, 2023, while those for the ITR-2 form were issued on January 31, 2024. To aid in timely tax filing, the CBDT has also made the online filing utilities available for ITR-1, ITR-2, and ITR-4 starting April 1, 2024, and for ITR-3 beginning May 9, 2024. These utilities can be accessed through the official portal at www.incometax.gov.in.

To ensure compliance with income tax regulations and to facilitate a smooth filing process, it is essential to select the appropriate ITR form based on your sources of income, residential status, and requirements for reporting assets and liabilities.

Guidelines for Choosing the Right ITR Form for FY 2023-24 (AY 2024-25)

- ITR-1 (Sahaj):

- Applicability: This form is suitable for resident individuals with an income up to ₹50 lakh from salaries, one house property, and other sources (excluding capital gains).

- Conditions: It is applicable if you do not have income from business or profession, and if you do not have any foreign assets or income.

- Usage: Ideal for salaried individuals, pensioners, and those with simple income sources.

- ITR-2:

- Applicability: Use this form if you have income from more than one house property, capital gains, or foreign income and assets. It is also for individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession.

- Conditions: Suitable for individuals with income from multiple sources or complex income structures, such as capital gains from the sale of assets or income from foreign investments.

- ITR-3:

- Applicability: This form is for individuals and HUFs who have income from a business or profession.

- Conditions: It is applicable if you are a partner in a partnership firm or have income from a proprietary business or profession.

- Usage: Ideal for those who need to report income from business or profession, including freelancers and consultants.

- ITR-4 (Sugam):

- Applicability: This form is for individuals, HUFs, and firms (other than LLPs) who have opted for the presumptive taxation scheme under Section 44AD, 44AE, 44ADA, or 44AF of the Income Tax Act.

- Conditions: Applicable if you have income from a business or profession and have opted for a presumptive taxation scheme.

- ITR-5:

- Applicability: This form is for firms, association of persons (AOPs), body of individuals (BOIs), and other entities such as LLPs.

- Conditions: Use this form if you are filing for a firm or similar entity.

- ITR-6:

- Applicability: This form is for companies other than those claiming exemption under Section 11 (for charitable or religious trusts).

- Conditions: Suitable for companies filing their returns, including those not seeking exemptions.

- ITR-7:

- Applicability: This form is for persons including companies who are required to file return under any of the sections 139(4A), 139(4B), 139(4C), or 139(4D) which cover trusts, political parties, and other specific entities.

- Conditions: Use this form if you are a trust or a non-profit organization, or if you fall under the specific categories requiring this form.

Conclusion

Selecting the correct ITR form is crucial for compliance with tax regulations and to ensure an efficient filing process. Each form caters to different types of income and entities. By understanding the specific requirements and eligibility criteria for each form, you can make an informed decision on which ITR form to use for FY 2023-24 (AY 2024-25).

Related posts:

Federal Bank Identifies Deposit Growth as Major Challenge for Indian Lenders.

Federal Bank Identifies Deposit Growth as Major Challenge for Indian Lenders.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

SEBI chairperson should resign, A probe JPC into Adani mega scam, Congress Said

SEBI chairperson should resign, A probe JPC into Adani mega scam, Congress Said

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

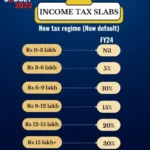

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)