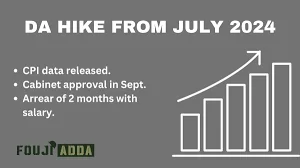

Following the release of the All India Consumer Price Index (AICPIN) data for June 2024, it has been confirmed that the Dearness Allowance (DA) for July 2024 will increase by 3%. This adjustment will bring the overall DA to 53% from 1st July 2024. While this increase is a welcome development for government employees, it raises important questions about whether the current DA rate is adequately keeping up with the pace of inflation.

53% DA from 1st July 2024 vs. Inflation

The primary function of the Dearness Allowance is to mitigate the impact of inflation on the salaries of government employees by compensating for the rising cost of essential commodities. However, the current rate of increase, especially during the 7th Central Pay Commission (CPC) period, appears to be insufficient when compared to historical figures. Over the years, during previous pay commission periods, the DA rates were adjusted more significantly to reflect the inflation trends, ensuring that employees’ purchasing power was not eroded by the rising cost of living.

The recent 53% DA, although representing the highest percentage since the 7th CPC was implemented, is notably lower when compared to the increments seen during the periods of the previous five pay commissions. This raises concerns that the current DA adjustments may not be fully compensating for the actual inflation rates. If the rate of inflation surpasses the DA increases, government employees may experience a decline in real income, meaning their salaries might not stretch as far as they once did when it comes to covering everyday expenses.

In essence, while the 3% increase to reach 53% DA is an improvement, it might not be sufficient to completely counterbalance the current inflationary pressures. This situation could lead to financial strain for government employees who rely on DA adjustments to maintain their standard of living amidst rising prices.

Related posts:

APSPDCL installs the state’s first high-tension and low-tension smart meters for the government sector.

APSPDCL installs the state’s first high-tension and low-tension smart meters for the government sector.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

US Fed must go big with 50 bps interest rate cut in September or risk recession

US Fed must go big with 50 bps interest rate cut in September or risk recession

8th Pay Commission 2024: Latest Updates on Notification, Salary Calculator and Key Information

8th Pay Commission 2024: Latest Updates on Notification, Salary Calculator and Key Information

Torrent Pharma Seeks $3 Billion to Acquire KKR’s Stake in JB Chemicals

Torrent Pharma Seeks $3 Billion to Acquire KKR’s Stake in JB Chemicals

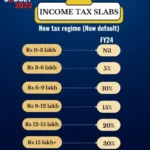

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)