Stocks to consider: Experts advise concentrating on high-quality stocks with favorable technical indicators for short-term gains. They suggest 11 stocks, including ITC, Wipro, Kotak Bank, IndusInd Bank, Mazagon Dock, and Bajaj Auto, which have the potential to rise by 5-16% over the next 3-4 weeks.

Stocks to watch: On Monday, August 19, the Nifty 50, the benchmark index of the Indian stock market, opened with a gain of about 0.40%, reaching 24,636.35. This followed a notable increase of nearly 2% in the previous session, where it closed at 24,541.15, driven by widespread buying amid positive global signals.

The market is currently experiencing a pattern of buying on dips and selling at higher levels. Despite its premium valuation, the market has shown resilience due to consistent buying by domestic investors.

Last week, the market made several attempts to rise but faced swift reversals, indicating potential selling pressure.

Prashanth Tapse, Senior Vice President (Research) at Mehta Equities, notes that the Nifty has support at 24,101 and targets in the range of 24,900-25,100.

Related posts:

Union Finance Minister Smt. Nirmala Sitharaman chairs the review meeting of the Regional Rural Banks (RRBs) in New Delhi, today

Union Finance Minister Smt. Nirmala Sitharaman chairs the review meeting of the Regional Rural Banks (RRBs) in New Delhi, today

APSPDCL installs the state’s first high-tension and low-tension smart meters for the government sector.

APSPDCL installs the state’s first high-tension and low-tension smart meters for the government sector.

US Fed must go big with 50 bps interest rate cut in September or risk recession

US Fed must go big with 50 bps interest rate cut in September or risk recession

China’s spending slump is taking its toll on e-commerce giant Alibaba, which missed earnings estimates.

China’s spending slump is taking its toll on e-commerce giant Alibaba, which missed earnings estimates.

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

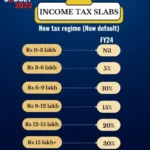

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)