Last year, the tax department discovered that some employees in Telangana and Andhra Pradesh had made false claims for deductions and tax exemptions to reduce their tax liabilities. This year, the department seems to be extending its focus to other cases. Chartered accountants have reported that the tax department is urging employers to advise their employees against making false claims for deductions or exemptions.

Several companies in cities such as Bangalore, Hyderabad, and Mumbai have been notified by the tax department about instances where employees have claimed a tax refund by reporting deductions beyond those listed in Form 16. While these claims might not necessarily be incorrect, they have been flagged by the tax department’s system as exceeding the figures reported in Form 16. Over the past year, the tax department has been issuing such alerts, as electronic tax return filing has made it easier to identify these discrepancies.

What does this recommendation from the income tax department inform employers?

According to Mihir Tanna, Associate Director at S.K. Patodia & Associates LLP, a CA firm, the advisory from the tax department directed to employers specifically noted that the department has identified instances where some employees have claimed incorrect or dubious tax deductions and exemptions. The advisory stated, “Our monitoring and field surveys have found that a considerable number of employees in your organization/company/department have sought refunds based on deductions and exemptions that seem suspicious or incorrect. These claims are currently under review by the Income Tax Department,” as mentioned in one of the advisories sent to a client of Tanna.

Tanna noted, “In previous years, tax officials discovered during search operations that many taxpayers had filed fraudulent income tax returns in an attempt to obtain refunds.”

What problem will employees face because of this issue highlighted by the tax department

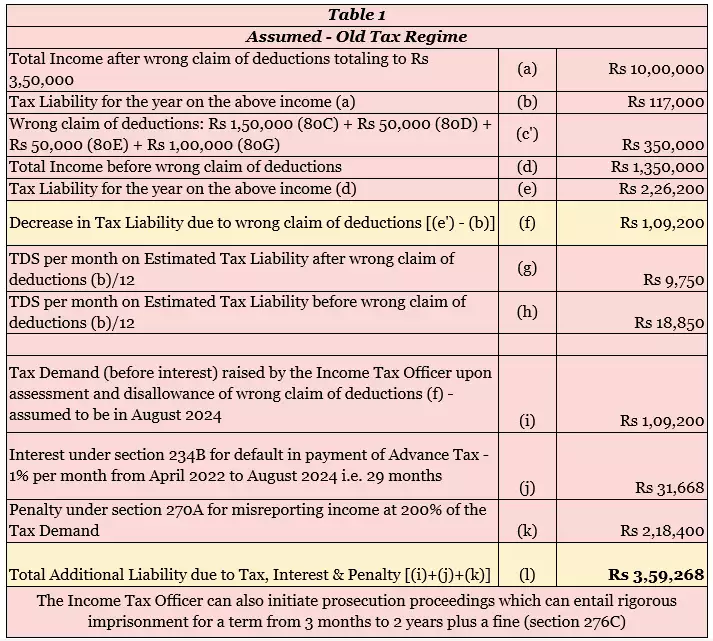

The entire tax liability calculation becomes disrupted. The table below illustrates how the calculation of TDS from salary is affected and, consequently, the amount of tax shortfall resulting from incorrect deduction claims.

The table below highlights the shortfall in TDS that resulted from the employee claiming deductions totaling Rs 3.5 lakh, including Rs 1.5 lakh under 80C, Rs 50,000 under 80D, Rs 50,000 under 80E, and Rs 1 lakh under 80G. In this example, the employee’s salary is considered to be Rs 13.5 lakh.

According to Jasmine Damkewala, Senior Partner at Circle of Counsels and Advocate-on-Record, Supreme Court of India, employees may encounter problems if the tax department identifies a TDS (Tax Deducted at Source) shortfall due to incorrect deductions or exemptions claimed.

“The tax department may issue a demand notice to you (the employee) for the shortfall amount, along with any applicable interest and penalties. If the deduction was accurate at the employer’s end and the correctly deducted tax was deposited on time, the company can provide these details to the tax department to settle its liability,” explains Damkewala.

“In simple terms, companies will need to provide the supporting documents submitted by employees under section 192(2D), which may be relevant to the ongoing inquiry or proceeding against such employees,” says CA (Dr.) Suresh Surana.

“There have been past instances where employees claimed incorrect exemptions or deductions, and the company deducted TDS based on these incorrect declarations. When the tax department later identified these issues, they were brought to the attention of the deductee company,” notes Atul Puri, Managing Partner and Co-Founder of SW India.

Related posts:

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

Crypto currency Price Updates

Crypto currency Price Updates

8th Pay Commission 2024: Latest Updates on Notification, Salary Calculator and Key Information

8th Pay Commission 2024: Latest Updates on Notification, Salary Calculator and Key Information

Bangladesh’s Economic Transformation: 15 Years of Rapid Growth, Diversification, and Resilience”

Bangladesh’s Economic Transformation: 15 Years of Rapid Growth, Diversification, and Resilience”

How to Claim Your Income Tax Refund Online for FY 2023-24

How to Claim Your Income Tax Refund Online for FY 2023-24

ITR Filing Forms for FY 2023-24 (AY 2024-25): How to Determine the Right Income Tax Return Form for You.

ITR Filing Forms for FY 2023-24 (AY 2024-25): How to Determine the Right Income Tax Return Form for You.