If you fall within the taxable income bracket, you have to choose between the old tax regime and the new tax regime when calculating your taxes. While the new tax regime offers lower income tax rates, the old tax regime allows for higher exemptions and deductions, potentially reducing your taxable income and, consequently, your tax liability. The old tax regime may be advantageous for many taxpayers who qualify for specific deductions and exemptions. Here’s an exploration of why the old tax regime might work better for you.

Deciding Between the Old and New Tax Regimes

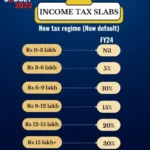

Under the new tax regime, taxpayers with an income of ₹7 lakh or less enjoy zero tax liability. Additionally, salaried individuals receive a standard deduction of ₹50,000, resulting in no tax for taxable incomes up to ₹7.5 lakh. However, if your taxable income exceeds ₹7.5 lakh, you will face tax on the entire amount, albeit at reduced rates.

According to Suresh Surana, Founder of RSM India, “The new tax regime offers lower rates but fewer deductions and exemptions. Opting for this regime means giving up most of the deductions available under the old regime.” For instance, deductions under sections like 80C, 80D, and 24 are not available in the new regime. The new regime does, however, allow for some deductions such as the standard deduction and family pension.

If your taxable income surpasses ₹7.5 lakh, it’s prudent to compare your tax liability under both regimes. “The choice between the old and new regimes should be based on various factors, including your income level, eligible deductions, investment choices, liquidity needs, and emergency fund requirements,” advises Surana.

Reasons the Old Tax Regime May Be Beneficial

- Dual Benefits of Investment and Tax Savings: The old tax regime offers opportunities for both regular investment and tax savings. Suresh Sadagopan, Founder of Ladder7 Financial Advisories, explains that the old tax regime encourages investment through tax-saving measures. “The new tax regime does not offer incentives for tax-saving investments, making the old regime more beneficial for those who wish to save on taxes through investments.”

You can claim a deduction of up to ₹1.5 lakh under Section 80C for eligible investments. This can significantly lower your taxable income, especially for individuals in higher tax brackets. For instance, investing in instruments like PPF or ELSS can reduce your taxable income by up to ₹1.5 lakh.

- Affordable Financial Protection: Under the old tax regime, you can claim deductions for insurance premiums. For life insurance premiums, you can deduct up to ₹1.5 lakh under Section 80C. Additionally, you can claim a deduction of up to ₹25,000 for premiums paid on health insurance for yourself, your spouse, and children if you are under 60 years old. If you pay premiums for a health insurance policy for senior citizen parents, you can claim up to ₹50,000.

- Enhanced Retirement Savings: For private sector employees, investing in the National Pension System (NPS) through the employer can lower taxable income. This option is available in both tax regimes, but the old tax regime provides broader tax-saving opportunities. Employers can contribute up to 10% of your basic salary to your NPS account, reducing your taxable income and saving on taxes.

- Additional Retirement Savings with NPS: Often, the ₹1.5 lakh limit under Section 80C is exhausted by contributions to EPF, education fees, and home loan principal repayments. The additional ₹50,000 investment option under Section 80CCD(1B) for NPS allows you to invest beyond the ₹1.5 lakh limit and receive further tax deductions.

- Tax Savings with Allowances: If you live in a rented house and receive House Rent Allowance (HRA), the old tax regime allows you to claim substantial deductions. For instance, individuals residing in metropolitan areas can claim up to 50% of their salary as HRA, which significantly reduces taxable income. You can also claim HRA benefits even if you have a home loan, provided the property is in a different city and is rented out. Similarly, Leave Travel Allowance (LTA) for travel expenses can further reduce your taxable income.

- Cost-Efficient Asset Acquisition with Loans: Home loans are a cost-effective borrowing option due to their low-interest rates. Home loan borrowers can claim up to ₹2 lakh per year as a deduction on interest payments under Section 24(b), applicable to both self-occupied and rented-out properties.

- Additional Deductions and Exemptions: The old tax regime offers various other deductions. You can claim deductions under Section 80G for donations to eligible institutions, up to ₹10,000 for interest earned on savings accounts under Section 80TTA, and up to ₹50,000 for senior citizens on interest from specified deposits. Education loan interest payments are fully deductible. The range of deductions and exemptions is extensive and caters to specific conditions and categories of taxpayers.

- Tax Savings and Wealth Building: Maximizing tax savings contributes to wealth accumulation. If you qualify for numerous deductions and exemptions, the old tax regime may offer greater tax savings compared to the new regime. “For individuals with substantial deductions under various sections of the Income Tax Act, sticking to the old tax regime might result in higher tax savings,” says Surana.

If you do not qualify for significant deductions, the new tax regime might be preferable, as it simplifies the tax process and reduces the tax burden for those without extensive deductions. “The new tax regime offers a more straightforward tax structure, which can benefit taxpayers who prefer simpler tax calculations,” adds Surana.

Cautions Regarding Tax Regime Selection

Be mindful of the rules governing tax regime changes. “An individual who does not derive income from business or profession can choose between the old and new tax regimes each financial year. However, a taxpayer deriving income from business or profession who opts out of the new tax regime under Section 115BAC can switch back to the new regime only once,” Surana advises.

8 Reasons Why the Old Tax Regime Remains Attractive for Many Taxpayers

If you fall within the taxable income bracket, you have to choose between the old tax regime and the new tax regime when calculating your taxes. While the new tax regime offers lower income tax rates, the old tax regime allows for higher exemptions and deductions, potentially reducing your taxable income and, consequently, your tax liability. The old tax regime may be advantageous for many taxpayers who qualify for specific deductions and exemptions. Here’s an exploration of why the old tax regime might work better for you.

Deciding Between the Old and New Tax Regimes

Under the new tax regime, taxpayers with an income of ₹7 lakh or less enjoy zero tax liability. Additionally, salaried individuals receive a standard deduction of ₹50,000, resulting in no tax for taxable incomes up to ₹7.5 lakh. However, if your taxable income exceeds ₹7.5 lakh, you will face tax on the entire amount, albeit at reduced rates.

According to Suresh Surana, Founder of RSM India, “The new tax regime offers lower rates but fewer deductions and exemptions. Opting for this regime means giving up most of the deductions available under the old regime.” For instance, deductions under sections like 80C, 80D, and 24 are not available in the new regime. The new regime does, however, allow for some deductions such as the standard deduction and family pension.

If your taxable income surpasses ₹7.5 lakh, it’s prudent to compare your tax liability under both regimes. “The choice between the old and new regimes should be based on various factors, including your income level, eligible deductions, investment choices, liquidity needs, and emergency fund requirements,” advises Surana.

Reasons the Old Tax Regime May Be Beneficial

- Dual Benefits of Investment and Tax Savings: The old tax regime offers opportunities for both regular investment and tax savings. Suresh Sadagopan, Founder of Ladder7 Financial Advisories, explains that the old tax regime encourages investment through tax-saving measures. “The new tax regime does not offer incentives for tax-saving investments, making the old regime more beneficial for those who wish to save on taxes through investments.”

You can claim a deduction of up to ₹1.5 lakh under Section 80C for eligible investments. This can significantly lower your taxable income, especially for individuals in higher tax brackets. For instance, investing in instruments like PPF or ELSS can reduce your taxable income by up to ₹1.5 lakh.

- Affordable Financial Protection: Under the old tax regime, you can claim deductions for insurance premiums. For life insurance premiums, you can deduct up to ₹1.5 lakh under Section 80C. Additionally, you can claim a deduction of up to ₹25,000 for premiums paid on health insurance for yourself, your spouse, and children if you are under 60 years old. If you pay premiums for a health insurance policy for senior citizen parents, you can claim up to ₹50,000.

- Enhanced Retirement Savings: For private sector employees, investing in the National Pension System (NPS) through the employer can lower taxable income. This option is available in both tax regimes, but the old tax regime provides broader tax-saving opportunities. Employers can contribute up to 10% of your basic salary to your NPS account, reducing your taxable income and saving on taxes.

- Additional Retirement Savings with NPS: Often, the ₹1.5 lakh limit under Section 80C is exhausted by contributions to EPF, education fees, and home loan principal repayments. The additional ₹50,000 investment option under Section 80CCD(1B) for NPS allows you to invest beyond the ₹1.5 lakh limit and receive further tax deductions.

- Tax Savings with Allowances: If you live in a rented house and receive House Rent Allowance (HRA), the old tax regime allows you to claim substantial deductions. For instance, individuals residing in metropolitan areas can claim up to 50% of their salary as HRA, which significantly reduces taxable income. You can also claim HRA benefits even if you have a home loan, provided the property is in a different city and is rented out. Similarly, Leave Travel Allowance (LTA) for travel expenses can further reduce your taxable income.

- Cost-Efficient Asset Acquisition with Loans: Home loans are a cost-effective borrowing option due to their low-interest rates. Home loan borrowers can claim up to ₹2 lakh per year as a deduction on interest payments under Section 24(b), applicable to both self-occupied and rented-out properties.

- Additional Deductions and Exemptions: The old tax regime offers various other deductions. You can claim deductions under Section 80G for donations to eligible institutions, up to ₹10,000 for interest earned on savings accounts under Section 80TTA, and up to ₹50,000 for senior citizens on interest from specified deposits. Education loan interest payments are fully deductible. The range of deductions and exemptions is extensive and caters to specific conditions and categories of taxpayers.

- Tax Savings and Wealth Building: Maximizing tax savings contributes to wealth accumulation. If you qualify for numerous deductions and exemptions, the old tax regime may offer greater tax savings compared to the new regime. “For individuals with substantial deductions under various sections of the Income Tax Act, sticking to the old tax regime might result in higher tax savings,” says Surana.

If you do not qualify for significant deductions, the new tax regime might be preferable, as it simplifies the tax process and reduces the tax burden for those without extensive deductions. “The new tax regime offers a more straightforward tax structure, which can benefit taxpayers who prefer simpler tax calculations,” adds Surana.

Cautions Regarding Tax Regime Selection

Be mindful of the rules governing tax regime changes. “An individual who does not derive income from business or profession can choose between the old and new tax regimes each financial year. However, a taxpayer deriving income from business or profession who opts out of the new tax regime under Section 115BAC can switch back to the new regime only once,” Surana advises.

Related posts:

Federal Bank Identifies Deposit Growth as Major Challenge for Indian Lenders.

Federal Bank Identifies Deposit Growth as Major Challenge for Indian Lenders.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

Bank Loans Exceed Rs 9 Lakh Crore; Financial Institutions Under Pressure to Secure Additional Funds.

SEBI chairperson should resign, A probe JPC into Adani mega scam, Congress Said

SEBI chairperson should resign, A probe JPC into Adani mega scam, Congress Said

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Did you incorrectly claim a deduction on your ITR? The Income Tax Department requires employees to correct the mistake and pay any outstanding tax, or face potential penalties.

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Is 53% DA from 1st July 2024 Truly Keeping Up with Inflation? The Lowest Rate in 5 Pay Commissions!

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)

Latest Income Tax Slabs and Rates for FY 2023-24 (AY 2024-25)